News and Updates

Deduction under Section 80C

Income Tax is a tax imposed by government on a person that is to be paid on the income earned by him or her in the previous year. Income Tax is a source of revenue for government. Income Tax return has to be filed annually by taxpayers to determine their tax obligations.

Some relaxations are also available for the taxpayers in the form deductions. These deductions help to lower the amount of income that is taxable and hence reduce the tax liability. One such type of deduction available to taxpayer is “Deduction under Section 80C”. This deduction is allowable to a person from their gross total income.

Who can claim this deduction?

- An Individual; or

- A Hindu Undivided Family (HUF).

Amount qualifying for Deduction.

As per assessment year 2020-21 the quantum of deduction available under section 80C is upto Rs 1,50,000.

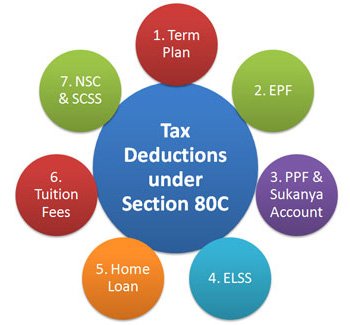

Investments/ contributions/ payments that qualify for Deduction.

- Life insurance premium paid on the life of self, spouse, or his or her children.

- Contribution by an individual towards Employee’s Provident Fund Scheme, Public Provident Fund Account, a recognised provident fund, etc.

- Investment in Unit Linked Insurance Plan 1971 of UTI, subscription to any units of UTI.

- Subscription to any notified security, notified deposit scheme of the Central Government, etc.

- Tuition fees paid by an individual to any educational institution situated in India, for full time education of any 2 of his/her children.

- Certain payments for purchase/construction of residential house property.

- Subscription to notified schemes of

(a) public sector companies engaged in providing log-term finance for purchase/construction of houses in India for residential purposes/

(b) authority constituted under any law for satisfying need for housing accommodation.

- Subscription to equity shares or debentures of any public company or public financial institutions, notified bonds issued by the NABARD.

- Term deposits for a fixed period of not less than 5 years with a scheduled bank or post office.

- Deposit in an account under the Senior Citizen Savings Scheme Rules, 2004.

We at Tax Avatar, will help you get a better and clear understanding of income tax and deductions related to it. We can help you reduce your tax liability by using these deductions under Section 80C and others that are available for you. We will use our expertise to benefit you by reducing your taxable income. We can help you file an Income Tax Return and save as much tax as possible in accordance to Income Tax Act, 1961. We will make sure that you become a well informed and aware taxpayer.

Comments

Leave a Reply

Your email address will not be published.