We offer comprehensive solution to your CIBIL Problems and Issues

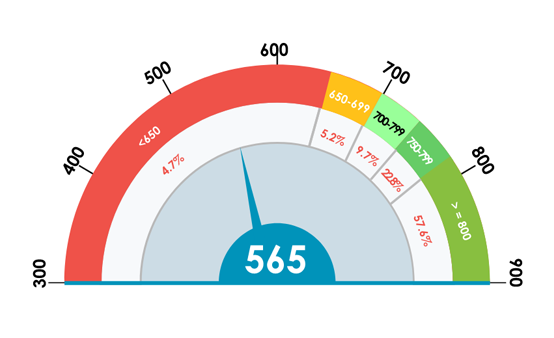

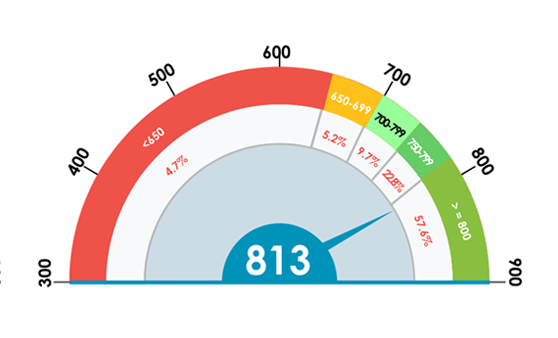

CIBIL REPORT & CIBIL SCORE

We help you get your CIBIL Report and CIBIL Score and analyze CIBIL issues and factors that impact your score.

RECTIFYING ERRORS

We assist in rectifying any errors and mediate with lenders.

ENHACE YOUR CREDIT SCORE

We will provide detailed action plan and score building options to help you improve your CIBIL score and enhance your credit score.